This article covers the 3rd part of the Vwap intraday strategy with a different logic.

You can read Part-1 and Part-2 here.

The only difference between this variation and part-2 is having stoploss based on fixed percentage(1%) from entry point instead of considering the decision candle low or high as stoploss.

Strategy Rules:

Timeframe: 15 minute

Its a breakout strategy.

Ignore first 15 minute candle after market opens to avoid noise in the market.

Stock Selection: Wait till 15 minutes after market opens. That means we need to wait till the first 15 minute candle is closed. Now at 09:30 AM choose top 2 gainers and top 2 losers from the Nifty 50 stocks. That means on any given day we are going to trade in 4 stocks at max.

Long Trade:

- First identify the decision candle on which we need to apply breakout rule. The decision candle is the one that passes through the VWAP line and closes above the VWAP line for taking long trade. Do not consider a candle if it does not touch the VWAP line.

- When the stock price breaks out the decision candle high enter a trade at high of decision candle.

- Stoploss: 1% from entry

- Target: 2% from entry

- Square off trade at 3:15 PM if no SL or target hits (15 minutes before market closes)

Short Trade:

- First identify the decision candle on which we need to apply breakdown rule. The decision candle is the one that passes through the VWAP line and closes below the VWAP line for taking short trade. Do not consider a candle if it does not touch the VWAP line.

- When the stock price breaks down the decision candle low enter a trade at low of decision candle.

- Stoploss: 1% from entry

- Target: 2% from entry

- Square off trade at 3:15 PM if no SL or target hits (15 minutes before market closes)

Capital: We are going to assume the total capital as 1 Lakh (1,00,000) for trading max 4 stocks on any given day. We risk only 1% of 1 Lakh on each trade i.e. the risk on each trade is 1,000. On a worst day if all 4 stocks hit stoploss then our max loss would be 4% for that day on total capital.

Back test Period: 01-01-2022 To 24-10-2024 (Approx. 3 years)

Charges: All charges like brokerage, STT, exchange transactions are considered while running back test.

Slippages: This back test does not account any slippages that we encounter in live trading.

Please note we don`t take another trade in the same stock after first trade SL hits.

To keep the back test simple, buffer (delta) value is not considered in this back test. Buffer is some extra value that we consider just above or below the breakout line.

Back test results:

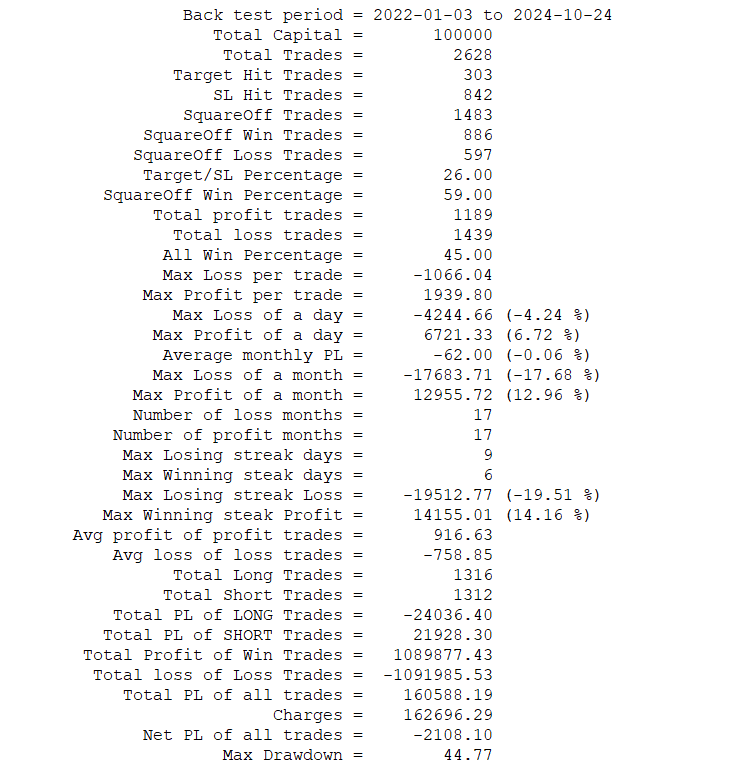

Here is the back test summary report. All the statistics mentioned in below screenshot are self-explanatory.

So, we would have lost 2% on capital if we would have traded this strategy in last 3 years. This is much better compare to part-2 logic where we had 64% loss. If you look at the numbers closely, infact the strategy made a profit of 160% in 3 years without charges. But the charges ate up all the profits and net result has turned into a bit negative value.

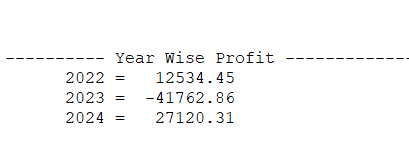

Conclusion: Despite we have been doing fine tuning from part-1, part-2 to part-3 we still ended up without any profit over the time period of 3 years. Please have a look at the above screenshot where it shows the year wise profit in which 2022 and 2024 gave gains while 2023 ended in loss. This clearly says finding a profitable intraday strategy over a longer time period is extremely difficult. I am not saying there wont be any profitable strategies in the longer time period, but its too difficult to identify such strategies in intraday. One has to put months and even years of effort to achieve the success in finding a profitable intraday trading system. Also even after finding a profitable intraday strategy it is very difficult to trade with strict discipline and proper risk management. On top of it there will be known and unknown challenges keep coming while executing the strategy in live.

I am providing you the complete back test report in the form of downloadable excel file at the bottom of the post.

The back test report contains following sheets:

- Trades: All trades with entry, exit, start and end timestamps, pnl, charges, net pnl etc.

- Symbol wise Pnl

- Date wise Pnl

- Date & Symbol wise Pnl

- Month wise Pnl

- Month & Symbol wise Pnl

- Year wise Pnl

- Year & Symbol wise Pnl

- Win Loss Ratio of each stock

- Summary report with important data.

I hope this would be helpful for you guys to do some further analysis.

Download Back test Report:

BackTest_VWAP_V3_2022-01-01_to_2024-10-24.xls