In this article, I am going to discuss about a compounding and rebalancing method that is useful while doing back testing to calculate accurate CAGR and drawdown. This can also be used by anyone to compound and rebalance their portfolio manually.

Why I have to come up with this method?

- During back testing of investment or swing trading strategies I found that there are some trades taking more than a year to hit stoploss or target.

- At present, whenever a trade is exited, I am considering the exited year for returns calculation. But some trades initiated 2-3 years ago causing a trade to span over multiple years.

- In this scenario, a trade gives different returns in each year. So, considering all the returns in a single (exited) year is not a correct method.

Who can use this method?

- Primarily this method is very useful in back testing to calculate accurate returns and drawdown value.

- Swing traders, Investors or anyone who want to compound and rebalance their portfolio in a systematic way.

How to calculate CAGR accurately !

- If a trade is spanning over multiple years, then split the trade into multiple sub trades, one sub trade for each year.

- In simple terms to achieve this, just sell the entire portfolio of trades at the end of the year (on the last trading day of the year) and convert into cash component. This cash component value will be the starting capital for the next year.

- Buy the same stocks again thus creating new trades on the same day (last trading of the year) from the cash component by rebalancing the portfolio. Rebalancing is optional.

Compounding method:

- Initial Capital = 10,00,000

- Max number of trades/stocks in portfolio = 10. That means at any point of time, the portfolio can contain 0 – 10 trades.

- The capital for each trade would be 10,00,000 / 10 = 1,00,000

- Consider 2 portfolios for easy calculation

- Cash component

- Stocks/Trades portfolio

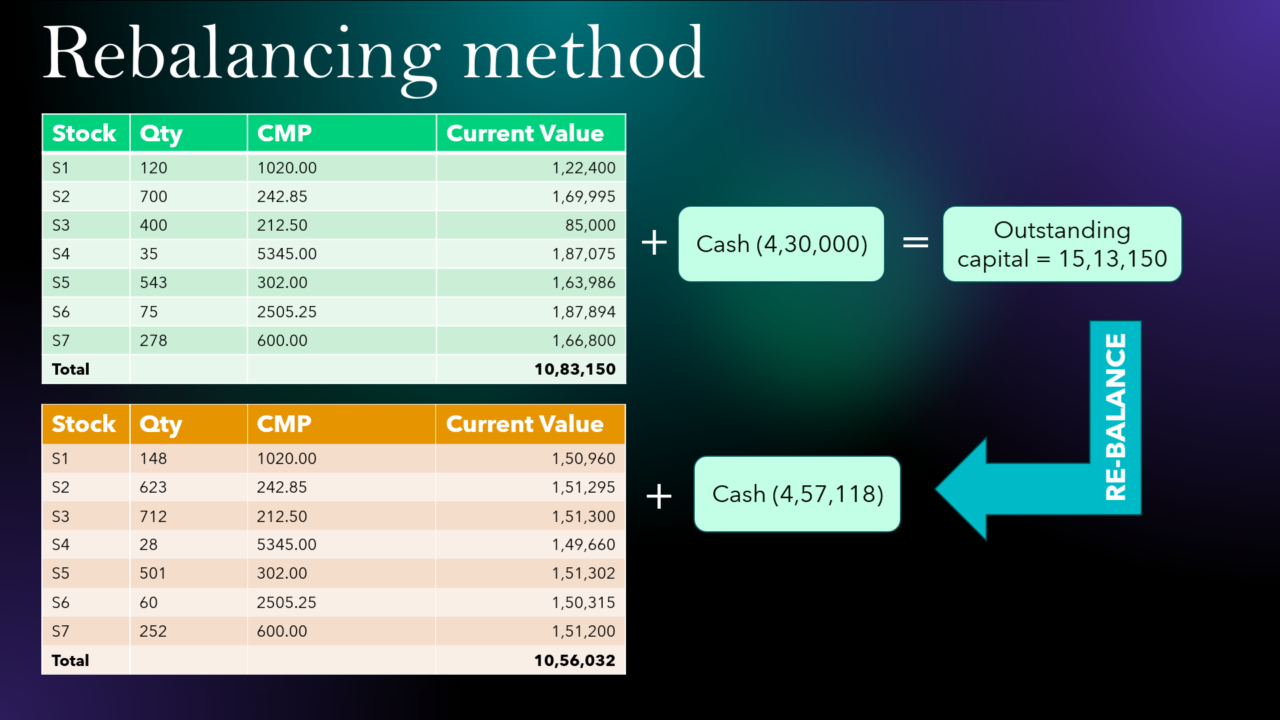

Rebalancing method:

Please watch below video for clear understanding of compounding and rebalancing methods.